OptionStation Pro

Theoretical Positions Panel

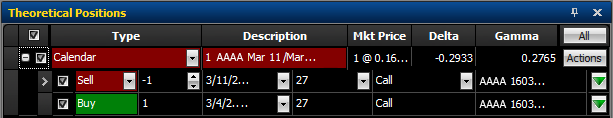

The Theoretical Positions panel is where your hypothetical positions are listed for analysis. Your theoretical positions can be selected to track changes in time, asset price, and volatility, allowing you to see how your position's profitability will change in relation to changes in market conditions.

Placing a Trade from the Theoretical Positions Panel

You can trade a position or individual legs from the Theoretical Positions panel. For more information, see Placing a Trade from a Theoretical Position.

Theoretical Positions Panel Layout

The panel layout contains columns and rows that provide you with detailed information for your theoretical positions and legs. Columns can be sorted and rows may be edited depending on the information displayed.

Theoretical Position Columns

The columns at the top of the Theoretical Positions panel refer to the fields in each position row (those starting with a  or

or  ). Columns for the Theoretical Positions panel can be added, removed, sorted, repositioned, copied to the clipboard, and exported to Microsoft Excel. You can also copy your symbol to the clipboard. For more information, see Formatting Columns.

). Columns for the Theoretical Positions panel can be added, removed, sorted, repositioned, copied to the clipboard, and exported to Microsoft Excel. You can also copy your symbol to the clipboard. For more information, see Formatting Columns.

Fixed columns (that always appear)

- Type - The name of the position type: Equity, Single, or the spread name.

- Description - Describes the spread by the direction, symbol, option term, strikes and option type (put or call) it contains. Mini option spreads will display a (10) in the description field following the underlying asset, while standard-sized option spreads do not have the size listed.

Default columns (in alphabetical order)

- Delta - The Delta option sensitivity of the theoretical position.

- Gamma - The Gamma option sensitivity of the theoretical position.

- Mkt Price - The current market price/premium of the position. See Displaying Market Price.

Other available columns (in alphabetical order)

- Ask - The current ask (offer or sale price) of the call or put option for the spread.

- Ask Size - The number of contracts or shares being offered for sale for each position shown.

- Bid - The current bid price of the call or put option for the spread.

- Bid Size - The number of shares being offered for purchase for the displayed symbol.

- Custom Name - The custom name you define.

- Max Reward - The maximum potential gain of the theoretical position.

- Max Risk - The maximum potential loss of the theoretical position.

- Mid - The mid price is the average of the bid and ask prices.

- Mkt Value - The current market value of the theoretical spread position. For options: (spread price * number of spreads in position * number of shares per contract). For equities: (stock price * number of shares).

- Pos Delta - The total Deltas of a position (single spread Delta * number of spreads in position * number of shares per contract).

- Pos Gamma - The total Gammas of a position (single spread Gamma * number of spreads in position * number of shares per contract).

- Pos Rho - The total Rho of a position (single spread Rho * number of spreads in position * number of shares per contract)

- Pos Theta - The total Thetas of a position (single spread Theta * number of spreads in position * number of shares per contract).

- Pos Vega - The total Vega of a position (single spread Vega * number of spreads in position * number of shares per contract).

- Pos Volatility - The value of the volatility calculation being used as the source to the options pricing model.

- Reward/Risk Ratio - The ratio of the max reward divided by the max risk.

- Rho - The Rho option sensitivity of the theoretical position.

- Risk/Reward Ratio - The ratio of the max risk divided by the max reward values.

- Side - Edit the Side field by selecting Buy or Sell. Doing so will reverse the number of contracts from positive to negative, or negative to positive, depending on the original disposition of the legs. In addition, it will reverse the remaining legs in the spread to retain the integrity of the original spread type. If the spread type is set to custom, however, the changes made are isolated to the selected spread leg.

- Theta - The Theta option sensitivity of the theoretical position. For more information, see the Glossary.

- Underlying - The symbol of the underlying asset.

- Vega - The Vega option sensitivity of the theoretical position.

- Volatility Mode - The type of the volatility calculation being used as the source to the options pricing model.

Theoretical Position Rows

The spread type you select (from the Options Chains panel) will determine the rows displayed for each spread in the Theoretical Positions panel. The spread type is listed in a row (starting with a  or

or  ) and each leg of a spread is displayed (indented) beneath the spread type.

) and each leg of a spread is displayed (indented) beneath the spread type.

-

- Expands the spread to display the legs in the spread position.

- Expands the spread to display the legs in the spread position.

-

- Collapses the spread to hide the legs in the spread position.

- Collapses the spread to hide the legs in the spread position.

-

- Displays in each leg, enabling you to switch them on or off. Checking the boxes for your spread or leg will allow it to be viewed in the Risk Graph. By using the check boxes you can see detailed analysis of your trade and review possible adjustments by adding or subtracting individual legs. It is very enlightening to see the effect a single leg has on the spread, and a useful tool for evaluating adjustment legs.

- Displays in each leg, enabling you to switch them on or off. Checking the boxes for your spread or leg will allow it to be viewed in the Risk Graph. By using the check boxes you can see detailed analysis of your trade and review possible adjustments by adding or subtracting individual legs. It is very enlightening to see the effect a single leg has on the spread, and a useful tool for evaluating adjustment legs.

Column headers for the Theoretical Position rows can be added, removed, sorted, repositioned, copied to the clipboard, and exported to Microsoft Excel. Right-click any leg row and select Show Column Headers to toggle the display of column names for the rows on or off. For more information,

see Formatting Columns.

- Symbol - Shows the symbol for each leg. You can copy your symbol to the clipboard. Refer to OSI Symbology in the glossary for full symbol definitions.

- Side - Allows you to edit the Side field by selecting Buy or Sell. Doing so will reverse the number of contracts from positive to negative or negative to positive depending on the original disposition of the legs. In addition, it will reverse the remaining legs in the spread to retain the integrity of the original spread type. If the spread type is set to custom, however, the changes made are isolated to the selected spread leg.

- Qty - Displays the quantity of contracts in each leg. A positive number signifies that the contracts are Buy To Open (BTO), where a negative number shows the contracts are Sell To Open (STO).

- Expiration - Displays the expiration term of each leg. The drop-down list in a leg provides other expiration terms that are available for that option.

- Strike - Displays the strike price of each leg. The drop-down list in a leg provides other strike prices that are available for that option.

- Type - The name of the option (equity, single, or spread type). Or, click the drop-down and choose custom. For more information, see Customizing a Spread.

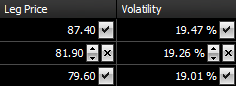

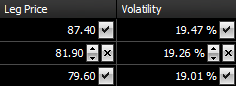

- Leg Price - Displays the price of each leg which is automatically set to the market price (default) from the option chain or manually set by the user. If the leg price is set by OS Pro, the price will either be the current market mid price or the market ask price, depending on the status of the Use Midpoint as Price check box in the Settings panel.

- Volatility - Displays the volatility of each position leg.

Adjusting Leg Price & Leg Volatility - You can adjust the price and volatility of any position leg. A check to the right of the column indicates that it is floating with the market price or volatility (market mode). An X indicates that it is being manually adjusted by the trader (manual mode). Price spinners are provided for adjusting the price or volatility while in the manual mode.

Adjusting Leg Price & Leg Volatility - You can adjust the price and volatility of any position leg. A check to the right of the column indicates that it is floating with the market price or volatility (market mode). An X indicates that it is being manually adjusted by the trader (manual mode). Price spinners are provided for adjusting the price or volatility while in the manual mode.

To switch between automatic and market modes, click on the check icon or X icon on the right-side of the column.

- SPC - The Shares Per Contract (SPC) column displays the contract specific deliverable. Most equity options have 100 shares per contract. For mini options, the shares per contract will be 10.

Note that non-standard options are restricted from being loaded into the Theoretical Positions panel. Closing non-standard options are allowed from the Real Positions panel.

Note that non-standard options are restricted from being loaded into the Theoretical Positions panel. Closing non-standard options are allowed from the Real Positions panel.

-

- Allows you to send the leg to the Order Bar. Click on the

- Allows you to send the leg to the Order Bar. Click on the  button and select Trade to trade a single leg. Or, select Delete Leg to delete a single leg. For more information, see Placing a Trade from a Theoretical Position.

button and select Trade to trade a single leg. Or, select Delete Leg to delete a single leg. For more information, see Placing a Trade from a Theoretical Position.

Analyzing a Trade

To analyze and plot the selected option spread in the 2D or 3D Graph, select the desired check boxes associated with each spread type or spread leg. You are able to include one or more spreads at the same time to be plotted. For more information, see 2D Graph and 3D Graph.

- Click

to display the legs for the selected spread. This allows you to view the parameters that make up that position – most typically they will be the legs in an option spread but they can also include shares of stock.

to display the legs for the selected spread. This allows you to view the parameters that make up that position – most typically they will be the legs in an option spread but they can also include shares of stock.

- Click

to hide the legs for the selected spread.

to hide the legs for the selected spread.

Customizing a Spread

Formatting Columns

Order Bar

Placing a Trade from a Theoretical Position

![]() or

or ![]() ). Columns for the Theoretical Positions panel can be added, removed, sorted, repositioned, copied to the clipboard, and exported to Microsoft Excel. You can also copy your symbol to the clipboard. For more information, see Formatting Columns.

). Columns for the Theoretical Positions panel can be added, removed, sorted, repositioned, copied to the clipboard, and exported to Microsoft Excel. You can also copy your symbol to the clipboard. For more information, see Formatting Columns.![]() or

or ![]() ) and each leg of a spread is displayed (indented) beneath the spread type.

) and each leg of a spread is displayed (indented) beneath the spread type. Adjusting Leg Price & Leg Volatility - You can adjust the price and volatility of any position leg. A check to the right of the column indicates that it is floating with the market price or volatility (market mode). An X indicates that it is being manually adjusted by the trader (manual mode). Price spinners are provided for adjusting the price or volatility while in the manual mode.

Adjusting Leg Price & Leg Volatility - You can adjust the price and volatility of any position leg. A check to the right of the column indicates that it is floating with the market price or volatility (market mode). An X indicates that it is being manually adjusted by the trader (manual mode). Price spinners are provided for adjusting the price or volatility while in the manual mode.

![]() Note that non-standard options are restricted from being loaded into the Theoretical Positions panel. Closing non-standard options are allowed from the Real Positions panel.

Note that non-standard options are restricted from being loaded into the Theoretical Positions panel. Closing non-standard options are allowed from the Real Positions panel. - Allows you to send the leg to the Order Bar. Click on the

- Allows you to send the leg to the Order Bar. Click on the  button and select Trade to trade a single leg. Or, select Delete Leg to delete a single leg. For more information, see Placing a Trade from a Theoretical Position.

button and select Trade to trade a single leg. Or, select Delete Leg to delete a single leg. For more information, see Placing a Trade from a Theoretical Position.