OptionStation Pro

Asset Panel

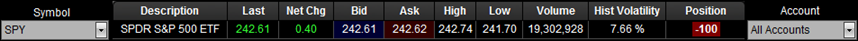

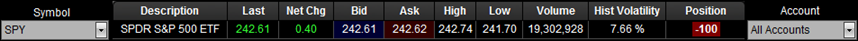

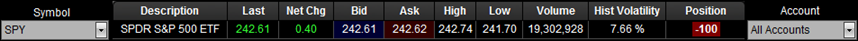

The first time you open OptionStation Pro the symbol for SPY will display. You can then select another symbol to trade. The next time you open OptionStation Pro, the last symbol you were looking at will display.

The Asset panel contains data relative to the selected underlying asset. This includes real-time prices, trading units, volume, and other pertinent information for assessing the financial instrument displayed. You can click on the Bid or Ask price to Sell or Buy, or right-click on the Bid or Ask price and select BUY or SELL to open the Trade Bar. Your order will be automatically populated and ready to trade.

Enter a Symbol

Enter a symbol name (or description) in the Symbol box. A drop-down symbol lookup list appears beneath the box to help you find the symbol name, description, exchange, and asset type based on the characters entered. You can display up to 40 of your Most Recently Used (MRU) symbols at the top of the list (adjustable in the Settings panel). Press the Enter key to load data from the underlying asset into the Asset panel and display the option chains in the Option Chains panel.

If you have multiple TradeStation accounts, you can use the Account drop-down list to select a different account, if available, or All Accounts to display all of your account information.

Asset Panel Columns

Columns for the Asset panel can be added, removed, repositioned, copied to your clipboard, and exported to Microsoft Excel.

Columns available for the OptionStation Pro Asset Panel:

Default columns

- Symbol – The symbol of the underlying asset. In TradeStation, a (D) notation following the symbol indicates delayed data. This means that data used for the underlying asset is being delayed by the exchange.

- Description – The description of the underlying asset.

- Last – The last traded price of the asset.

- Net Chg – The net change of the asset since the last daily close.

- Bid – The current bid price of the asset. When you hover your cursor over the price, the text Sell appears. Click on the price to open the Trade Bar. Your order will be automatically populated and ready to trade.

- Ask – The current offer of the asset. When you hover your cursor over the price, the text Buy appears. Click on the price to open the Trade Bar. Your order will be automatically populated and ready to trade.

- High – The high price of the asset for the day.

- Low – The low price of the asset for the day.

- Volume – The number of shares traded so far in the current day. The Asset panel displays shares; the Option Chains panel displays contracts.

- Hist Volatility – The historical volatility of the asset, using the last 20-250 daily closing prices (adjustable in the Settings panel).

- Position – The number of shares (+ for long and - for short).

- Account – The TradeStation account number of the asset being used. Use the drop-down list to select a different account, if available, or All Accounts to display all of your account information. Selecting an account will cause the Options, Analysis, and Manage tabs, as well as the Today's Orders panel, to filter your results based on that account.

Other available columns

- 52 Wk High – The high of the last 52 weeks.

- 52 Wk Low – The low of the last 52 weeks.

- Ask Size – The number of shares being offered for sale for the displayed symbol.

- Beta – The ratio measuring the movement of an underlying asset compared to the market as a whole – typically the S&P 500. If the beta equals 1, then the asset moves very closely to the market. If the beta is greater than 1, then the asset moves more aggressively than the market. If the beta is -1, then the asset moves exactly opposite of the market.

- Bid Size – The number of shares being offered for purchase for the displayed symbol.

- Close – The closing asset price from regular trading hours.

- Expiration – The date the asset expires.

- Mid – The mid price is the average of the bid and ask prices.

- Net %Chg – The net change in percent since the last daily close.

- Open – The opening asset price from regular trading hours.

- Prev Close – The closing price from the previous regular trading session.

- Prev Volume – The number of shares traded from the previous regular trading session.

- VIX Volatility – The current volatility of the average implied volatility of the options in the option chains, using the CBOE Volatility Index (VIX) calculation.

Placing a Trade

You can place a trade in the Asset panel in one of two ways:

- Click on the Bid or Ask price to Sell or Buy.

- Right-click on the Bid or Ask price and select BUY or SELL.

The Trade Bar will open with your order automatically populated and ready to trade.

Analyzing an Equity

To trade or analyze an individual equity, simply right-click on the Bid or Ask price from the Asset panel and then select Analyze Buy or Analyze Sell from the drop-down menu. The Positions and Simulations panel opens on the Analysis tab and displays the long (buy) or short (sell) equity, as well as adds the equity you selected to analyze to the 2d or 3d graph.

From the Positions and Simulations panel you can send a Buy/Buy to Cover order or a Sell Short/Sell order for a stock leg to the Trade Bar. After the order is sent to the Trade Bar you can modify the order parameters (Order Type, Price, etc.) before placing the order. Once the equity order is placed, it appears on Today's Orders panel in the Manage tab. After the order is filled, the positions will appear in the Positions panel in the Manage tab.

Formatting Columns in OptionStation Pro