OptionStation Pro

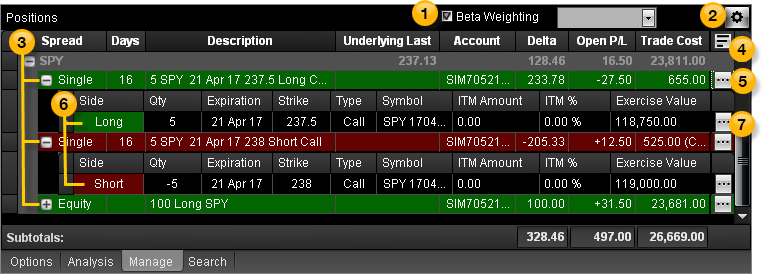

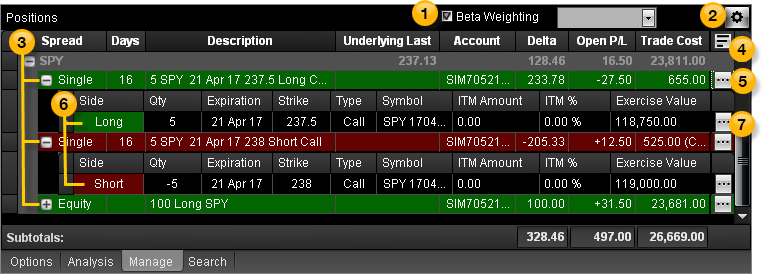

The Positions panel in the Manage tab lets you build spreads and view your current positions as a portfolio. When new single legs arrive in the Positions panel, each is placed in a separate single spread. You can combine leg positions into named spreads.

The Positions Panel is where your current positions are listed. You can right-click anywhere on the desired position row, and select Load Underlying Option Chain from the shortcut menu to load the symbol into the symbol box and Asset panel, along with the associated option chain.

Subtotals are listed at the bottom of the panel, whether they are weighted or not.

You can re-combine legs into positions using OptionStation Pro's SpreadMaster feature. For example, you can create named spreads from existing legs to make it easier to keep track of your positions and close or roll them with a single order. You can also drop a position into an existing position so you don't have to drag individual option legs to combine positions.

The panel contains the following features:

These features are used to manage your positions:

Beta Weighting

Beta WeightingSelect the Beta Weighting checkbox and enter a symbol name (or description) in the Symbol box. This allows you to view your portfolio as if it was the equivalent of that symbol, by modifying the value in the Delta column of each position to approximate the number of shares of that symbol. For example, if you beta weight your portfolio against the SPY and your deltas total 500, your portfolio approximates the equivalent to that of 500 shares of the SPY. This enables you to see your long/short delta exposure based on a single symbol, and may be useful to determine position adjustments and hedging.

Configure

Configure Click the ![]() on the upper right of the Positions panel to select configuration settings.

on the upper right of the Positions panel to select configuration settings.

Format Columns - Opens the Format Columns dialog that lets you add or remove columns and change the column order.

- Best Fit (All Columns) - Automatically adjusts the width of columns that are displayed for the selected panel.

- Copy All Rows - Copies all rows to the clipboard.

- Export to Excel - Exports your position data to Microsoft Excel.

Spread Rows and Columns

Spread Rows and ColumnsFollowing is a list of available Positions columns:

Default columns (in order of appearance)

- Spread - The name of the spread; for example, Butterfly, Single, etc.

- Days - The number of days to expiration an option has left. Blanks are displayed for equity positions. You can sort positions from earliest to latest or from latest to earliest.

- Description - Describes the spread by the direction, symbol, option term, strikes, and option type (put or call) that it contains. Mini option spreads will display a (10) in the description field following the underlying asset, while standard-sized option spreads do not have the size listed.

- Underlying Last - The real-time underlying last price.

- Account - The TradeStation account number for each position.

- Delta - The total Deltas of a position (single spread Delta * number of spreads in position * number of shares per contract).

- Open P/L - The estimated profit or loss (P/L) of closing the position.

- Trade Cost - The position's aggregate trade cost.

Other available columns (in alphabetical order)

- Ask - The current ask (offer or sale price) of the call or put option for the spread.

- Bid - The current bid price of the call or put option for the spread.

- Est Closing Cost - The estimated cost of closing the position.

- Est Closing Price - The estimated price of closing the position.

- Expiration - The expiration date of the position. If the position contains options with different expiration dates, the earliest date is displayed.

- Gamma - The total Gammas of a position (single spread Gamma * number of spreads in position * number of shares per contract).

- ITM - Displays ITM when at least one option within an underlying group is In-The-Money (ITM).

- Max Reward - The maximum potential gain of the position.

- Max Risk - The maximum potential loss of the position.

- Mid - The mid price is the average of the bid and ask prices.

- Mkt Value - The current market value of the spread position. For options: (spread price * number of spreads in position * number of shares per contract). For equities: (stock price * number of shares).

- Notes - The custom note you define.

- Open P/L % - The estimated closing P/L in percentage format. N/A is displayed if the trade cost is zero, which avoids a divide by zero condition.

- Price - The current market price/premium of the position.

- Reward/Risk Ratio - The ratio of the max reward divided by the max risk.

- Risk/Reward Ratio - The ratio of the max risk divided by the max reward.

- Theta - The total Thetas of a position (single spread Theta * number of spreads in position * number of shares per contract).

- Trade Price - The aggregate trade price for the position (on a per spread basis).

- Underlying - The symbol of the underlying asset. Group subtotals are displayed in the underlying group row.

- Vega - The total Vega of a position (single spread Vega * number of spreads in position * number of shares per contract).

- Volatility - The value of the volatility calculation being used as the source to the options pricing model.

- Volatility Mode - The type of the volatility calculation being used as the source to the options pricing model.

Position Controls

Position Controls Click the ![]() on the right side of each spread column headers for the position controls:

on the right side of each spread column headers for the position controls:

Spread Controls

Spread Controls Click the ![]() on the right side of each spread row for the spread controls:

on the right side of each spread row for the spread controls:

These features are used to manage legs in a spread:

Leg Rows and Columns

Leg Rows and ColumnsBeneath the position spread headings are the legs that make up your option holdings for the current underlying symbol.

To show or hide leg column headers:

Right-click on a leg row and select Show Column Headers from the shortcut menu.

Right-click on a leg row and select Show Column Headers from the shortcut menu.

Leg columns include the following values from left to right:

- Side – Shows the side (long or short) of each leg.

- Qty - Shows the number of contracts in each leg.

- Expiration - Shows the expiration term of each leg.

- Strike - Shows the strike price of each position leg. For equity positions, this column is blank.

- Type - Indicates whether the options in the leg are Calls or Puts.

- Symbol - The symbol for each position leg. Refer to OSI Symbology in the glossary for full symbol definitions.

- Underlying Asset - The symbol; for example, SPY. Note that a 7 at the end of the asset indicates a mini option.

- Expiration Date - The date format is YYMMDD; for example, 170701 is July 1, 2017.

- Option Type - Displays C for call or P for put.

- Strike Price - The price points of the underlying asset that are usually incremented by 0.5, 1, 2.5, 5, or 10 points.

- ITM Amount - Shows how much, in points, an In-The-Money option is In-The-Money. This is also referred to as an option’s intrinsic value.

- ITM % - Shows an option’s In-The-Money amount in percentage format.

- Exercise Value - Shows the exercise value of each option leg.

- SPC - Shares Per Contract (SPC) displays the contract specific deliverable. Most equity options have 100 shares per contract. For mini options, the shares per contract will be 10.

Leg Controls

Leg Controls Click the ![]() on the right side of each leg row for the leg controls:

on the right side of each leg row for the leg controls:

- Split - This will split a leg with a quantity of two of more into two separate legs. Adjust each spread independently to any quantity that sums to the original leg quantity.

- Close Leg - This will send your closing order for the leg to the Trade Bar. From the OptionStation Pro Trade Bar, select your order criteria. The Confirmation dialog displays with the order details of your closing trade.

- Roll Leg -This will send your rolling order for the leg to the Trade Bar.