Balances

The Balances app shows your balances across your accounts and by asset class category.

Overview

The following outlines the general steps you will follow when using the Balances app. Click on the information icons throughout the Balances app for more details on the selected topic.

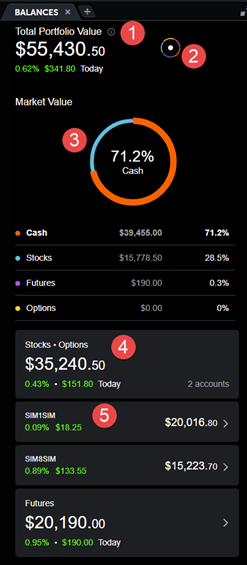

Portfolio View Layout

If you have multiple accounts, Balances will display a summary view that includes all of your accounts. If you have a single account, you can skip down to the Account View Layout.

1 Total Portfolio View

The total portfolio value allows you to keep tabs on all assets in your TradeStation Securities account(s) plus your cash balance (includes stocks, futures, options).

2 Turn Portfolio Mix On/Off

The Portfolio Graph and Mix can be turned on or off by clicking on the chart icon to the right of the Portfolio Value.

3 Portfolio Mix

Directly located below your Total Portfolio Value, is your Portfolio Mix. This shows a visual representation of your portfolio mix in a pie chart. Each color represents a different asset class. You can click on a section of the chart or the grid to display that asset class.

4 Asset Type Card

Asset type cards will display for each account type, Stocks and Futures. If you have multiple accounts for an asset class, the card will display a combined value for each account. The card will display the combined account value, profit/loss and profit/loss percent for the current day. If you only have one account for the asset class, you can click on the Asset Type card to view the account summary.

5 Individual Account Cards

If you have multiple accounts for an asset type, they will display individually below the Asset Type card. The card will display the account number or account alias, account value, profit/loss and profit/loss percent for the current day. You can click on the card to view the account summary.

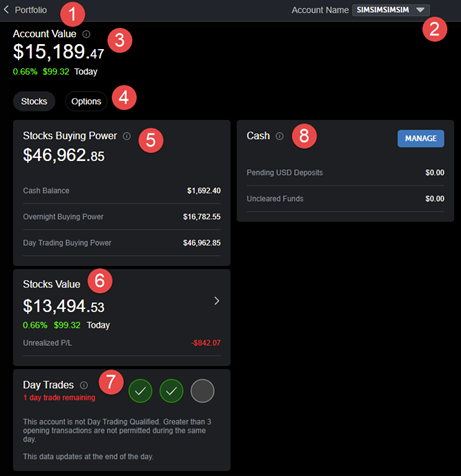

Equity Account View Layout

1 Portfolio View

Click here to return to the Portfolio overview.

2 Account Dropdown

Use the account pull-down to switch between accounts.

3 Account Value

The Account Value includes the amount you have invested in stocks and options plus the amount of cash in your equities account. Shown below the Account Value, you can see the real-time percent change and dollar change of your equity’s portfolio on the day.

4 Asset Class

If you have an equity account approved for option trading, you can switch between your stock and option positions.

5 Buying Power

Stocks Buying Power

The money available to purchase or short sell stocks. Buying power is equal to the total cash held in your account plus funds available to borrow, also referred to as margin.

Cash Balance

The total cash funds in the account. This may be a negative number if you are borrowing funds, also referred to as margin. A positive Cash Balance may not always be funds that are available to trade, depending on the margin requirements of current positions.

Overnight Buying Power

The maximum funds available for holding positions through the pre- and post- market sessions. This may mean that you are borrowing funds, also referred to as margin.

Day Trading Buying Power

The maximum funds available for holding positions during the regular market session. This may mean that you are borrowing funds, also referred to as margin.

6 Positions Value

See the current market value of your stock or option positions including the profit/loss and profit/loss percent for the current day. When you click the card, the positions app will open for the selected account.

7 Day Trades

Exhibits the number of equity and option day trades that have taken place in the past five business days. This is a beginning of day value and does not update intraday.

A Day Trade is defined as the opening and closing of a transaction in the same security in a margin account in the same trading day. Pattern Day Traders with account balances less than $25,000 will face restrictions on further trading. FINRA rules state that PDT will be restricted from placing opening transactions for 90 days unless enough cash is deposited to restore the balance to $25,000 or more within 5 days.

Knowing the PDT rules is crucial so that you can avoid having restrictions placed on your account.

Pattern Day Traders are defined as traders who:

Execute 4 or more-day trades over the span of 5 business days in a margin account

The number of day trades must constitute more than 6% of the main account’s total trade activity during the same time window.

The cash amount in the account must be at least $25,000

8 Cash

Select the Manage button to transfer funds to and from your account.

The cash card displays the following:

Pending USD Deposits

Displays the total of uncleared checks received by TradeStation for deposit.

Uncleared Funds

Shows the funds received by TradeStation that are not settled from a transaction in the account.

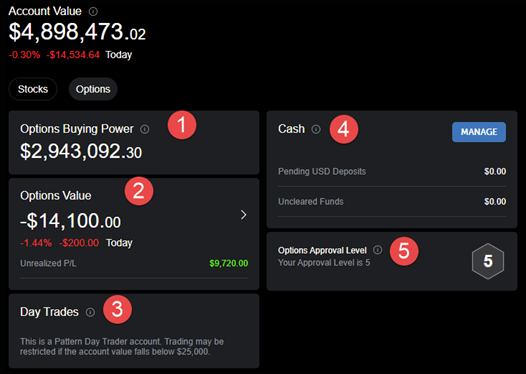

Option Account View Layout

1 Options Buying Power

Options Buying Power is the money available to purchase options. Options are not marginable, meaning that you cannot borrow funds to purchase.

2 Options Value

The options value represents the market value of your current options positions in real-time. Realized and unrealized profit and loss (P/L) is also displayed.

3 Day Trades

Exhibits the number of equity and option day trades that have taken place in the past five business days. This is a beginning of day value and does not update intraday.

A Day Trade is defined as the opening and closing of a transaction in the same security in a margin account in the same trading day. Pattern Day Traders with account balances less than $25,000 will face restrictions on further trading. FINRA rules state that PDT will be restricted from placing opening transactions for 90 days unless enough cash is deposited to restore the balance to $25,000 or more within 5 days.

Knowing the PDT rules is crucial so that you can avoid having restrictions placed on your account.

Pattern Day Traders are defined as traders who:

Execute 4 or more-day trades over the span of 5 business days in a margin account

The number of day trades must constitute more than 6% of the main account’s total trade activity during the same time window.

The cash amount in the account must be at least $25,000

4 Cash

Select the Manage button to transfer funds to and from your account.

The cash card displays the following:

Pending USD Deposits - Displays the total of uncleared checks received by TradeStation for deposit.

Uncleared Funds - Shows the funds received by TradeStation that are not settled from a transaction in the account.

5 Options Approval Level

Your Option Approval Level dictates what option trading strategies you can employ in your account.

Options Levels:

1. Covered Calls & Cash-Secured Puts. Covered calls are when the options writer holds the underlying equity shares and can provide physical delivery if the share price exceeds the strike price. Cash-secured puts means that you have the cash on hand to purchase the shares to satisfy the exercise of the put.

2. Long Options. Involves option buying. The option could expire worthless, delivering a complete loss to the owner.

3. Options Spreads. Options spreads include buying and selling the equivalent number of options in the same underlying security, but with different strike prices or expiration dates. You must demonstrate proven competence in options trading to be eligible for this level.

4. Naked Calls and Puts. Involves selling short call or put options. The potential for loss is unlimited. Traders in this level must demonstrate a high level of options trading experience.

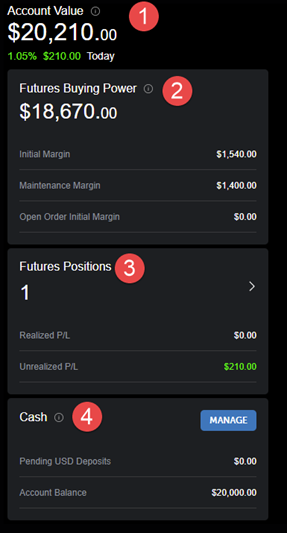

Futures View Account Layout

1 Buying Power

Futures Buying Power

The amount of cash available to invest less the commission.

Initial Margin

The sum of initial margin of all of your positions. The initial margin is the amount of funds that must be available to open a position.

Maintenance Margin

The sum of maintenance margins of all your positions. If the account drops below the maintenance margin, the account will receive a margin call.

Open Order Initial Margin

The sum of open order initial margins for all of your positions. This value is the amount of funds that must be available for open orders.

2 Futures Positions

Displays the number of positions in your futures account.

The Realized Profit Loss will include the gain or loss on any closed futures positions for the current day.

The Unrealized Profit Loss displays the profit/loss on open positions for the current day.

When you click on the futures card, the Positions app for the selected account will display.

3 Futures Account Value

The total dollar amount of futures contracts held in your futures account. Remember that your Futures account is separate from your equities accounts. If you would like to transfer between click on the Manage button on the Cash Card.

4 Cash Card

Select the Manage button to transfer funds to and from your account.

Pending Deposits - Displays the total of uncleared checks received by TradeStation for deposit.

Account Balance - The amount of cash available to invest.