Option Types - Basic Puts and Calls

We know that an option contract is defined as a contract that conveys to its holder the right, but not the obligation, to buy or sell a fixed amount of the underlying asset at a specified price on or before a given date. When the option contract is for the right to buy the fixed amount, it is known as a call. When the option contract is for the right to sell the fixed amount, it is known as a put. This is the option type.

A call option gives the holder of the option contract the right to buy a fixed number or amount of the underlying asset from the writer (seller), at a fixed price, on or before a specified date. If the holder exercises this right, the writer of the option is obligated to deliver a fixed number or amount of the underlying asset at the fixed price. Call options are considered bullish because the holder benefits when the underlying asset price increases above the strike price of the option. For more information, see About the Call Option.

A put option gives the holder of the option contract the right to sell a fixed number or amount of the underlying asset to the writer, at a fixed price, on or before a specified date. If the holder exercises this right, the writer of the option is obligated to buy the fixed number or amount of the underlying asset from the holder at the fixed price. Put options are considered bearish because the holder benefits when the underlying asset price decreases below the strike price of the option. For more information, see About the Put Option.

Most symbols represent the components described above, but the method in which they are built and how they appear varies between datafeed vendor. This is because each data provider uses its own set of rules for building a symbol.

To demonstrate how an option symbol is built, we will use Microsoft for a stock option symbol and U.S. Treasury Bond for a futures option symbol. Other options use different build rules and will not be similar to the following examples. However, these examples demonstrate the general structure and components that option contract symbols have.

Stock Option Symbol

The option symbol for a Microsoft stock option might be shown as "MSFT 110122C27.5". As shown below, "MSFT" identifies the root symbol for the underlying asset MSFT, the numbers "110122" signifies the expiration date, the letter "C" signifies a call option, and the number "27.5" signifies the 27.5 strike price.

[Option Root]<space>[YYMMDD Expiration Date][C or P][Strike Price]

Example:

The symbol for a MSFT January 2011 27.5 Call is "MSFT 110122C27.5"

- MSFT is the option root symbol for the underlying asset MSFT

- 110122 is the expiration date in YYMMDD format for January 22, 2011

- C represents a call option

- 27.5 is the strike price

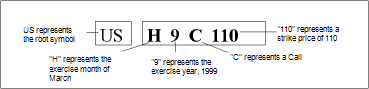

Futures Option Symbol

A futures option symbol, while still using letters of the alphabet to represent information on the symbol, also includes the actual strike price and a little more information. Below is an example of a U.S. Treasury bond futures option symbol.