About In-the-Money, Out-of-the-Money, and At-the-Money Options

These terms are key to understanding the value of your options contract at any point in time over the period of the contract. These terms describe the relationship of the underlying asset relative to the strike price of the option. This is true for any kind of option (i.e., stock, futures, index, etc.).

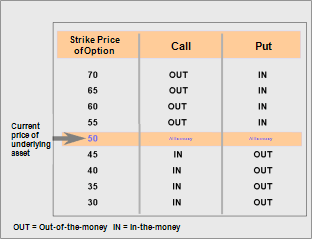

A call option is said to be in-the-money (ITM) if the underlying asset price is higher than the strike price. This is because the call option becomes profitable when the underlying asset price rises above the strike price. Remember, call options are bullish and benefit from an increase in the price of the underlying asset. Conversely, a call option is considered out-of-the-money if the underlying asset price is lower than the strike price.

For example: XYZ is trading at $60. The XYZ April 50 Call is in-the-money by 10 points, and the XYZ April 70 Call is out-of-the-money (OTM) by 10 points.

A put option is said to be in-the-money if the underlying asset price is lower than the strike price of the option. This is because the put option becomes profitable when the underlying asset price falls below the strike price. Put options are bearish and benefit from a decrease in the price of the underlying asset. Conversely, a put option is termed out-of-the-money if the underlying asset price rises above the strike price.

For example: XYZ is trading at $40. The XYZ April 50 Put is in-the-money by 10 points, and the XYZ April 30 Put is out-of-the-money by 10 points.

At-the-money (ATM) refers to any option, put or call, whose underlying asset market price is exactly the same as the strike price. Options traders also will term an option "around the money" when the underlying asset price is close to an option's strike price.

These three conditions, ITM, OTM, and ATM, have a distinct impact on the value of the option itself because they define the relationship between the price of the underlying asset and the strike price of the option. Generally, the more in-the-money an option becomes, the more value the option has. The more out-of-the-money an option becomes, the lower the value. However, the value of an option is also impacted by the days left to the expiration of the contract, the volatility of the underlying asset, and to a lesser degree by the risk-free interest rates and dividends. An example of how this relationship works is shown in the graphic below.