About Long and Short Positions

A position can also be described as a long position or a short position. Used in conjunction with puts and calls, a position can be a long call, long put, short call, short put, or any combination of these. Each of these positions represents a different way in which the trader or investor has traded a particular option. Each option can be applied by itself as a position, or used in combination with other options to create a position. Whether a position is one contract that is either long or short, or is a combination of longs and shorts, it represents some type of search strategy.

A Long position is when the holder buys an option to open a position, and where the number or price of options bought exceeds the number or price of options sold. A Short position is when the writer sells an option to open a position, and where the number or price of options sold exceeds the number or price of options bought.

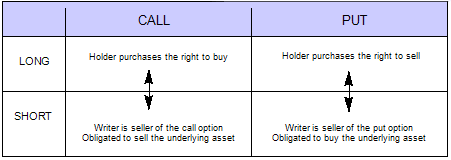

To review the definitions of puts and calls, a call gives the holder the right to buy a fixed number or amount at a fixed price on or before a specified date. A put gives the holder the right to sell a fixed number or amount at a fixed price on or before a specified date. Now, if we put long and short positions together with put and call options, we have the four basic legs used in options trading to build positions: long call, short call, long put, and short put.

- Long call - Where the holder opens a position by purchasing an option giving him or her the right to buy the underlying asset per the terms of the option contract.

- Short call - Where the writer opens a position by selling a call option and has an obligation to sell that underlying asset if the option is exercised (assigned) per the terms of the option contract.

- Long put - Where the holder opens a position by purchasing an option giving him or her the right to sell the underlying asset per the terms of the option contract.

- Short put - Where the writer opens a position by selling a put option and has the obligation to buy the underlying asset if the option is exercised (assigned) per the terms of the option contract.

The holder of the option, who is said to be long, pays a price, called a premium, to purchase the option from the writer. The writer of the option, who is said to be short, receives the premium from the holder. This premium is the only currency risk the holder incurs, and the only profit the writer realizes. Each of these positions will benefit from some kind of market move in price by the underlying asset.

Four basic legs used to build options trading positions: