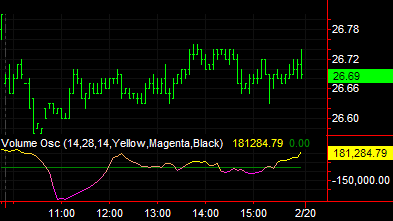

Volume Osc (Indicator)

Volume Osc (Indicator)

Input Information

| Name | Expression | Default | Description |

| FastLength | Numeric | 14 | Number of bars used to calculate the fast volume moving average. |

| SlowLength | Numeric | 28 | Number of bars used to calculate the slow volume moving average. |

| ColorNormLength | Numeric | 14 | Number of bars over which to normalize the indicator for gradient coloring. |

| UpColor | Numeric | Yellow | Color to use for indicator values that are relatively high over ColorNormLength bars. Set to -1 to disable gradient color plotting. |

| DnColor | Numeric | Magenta | Color to use for indicator values that are relatively low over ColorNormLength bars. Set to -1 to disable gradient color plotting. |

| GridForegroundColor | Numeric | Black | Color to use for numbers in RadarScreen cells when gradient coloring is enabled, that is, when both UpColor and DnColor are set to non-negative values. |

Market Synopsis

The Volume Oscillator indicator calculates a fast and slow volume moving average. The difference between the two (fast volume ma - slow volume ma) is then plotted. Volume can provide insight into the strength or weakness of a price trend. This indicator plots positive values above the zero line, and negative below. A positive value suggests there is enough market support to continue to drive price activity in the direction of the current trend. A negative value suggests there is a lack of support and prices may begin to become stagnant or reverse.

Plot Information

| Number | Name | Default Color | Description |

| Plot1 | VolOsc | Yellow/Magenta | Plots the Volume Oscillator value. |

| Plot2 | ZeroLine | Dark Green | Plots a reference line at zero. |

When applied to a chart, this indicator contains two plots, displayed in a separate subgraph from the price data.

Set either UpColor and/or DnColor to -1 to disable gradient plot coloring. When disabled, Plot1 color is determined by settings in indicator properties dialog box. Plot2 (ZeroLine) color always comes from indicator properties dialog box.

![]() This indicator only returns significant results when applied to bars with a time interval of daily or larger.

This indicator only returns significant results when applied to bars with a time interval of daily or larger.