TRIX (Indicator)

TRIX (Indicator)

Input Information

| Name | Expression | Default | Description |

| Price | Numeric | Close | Price used to calculate TRIX. |

| Length | Numeric | 9 | Number of bars used to calculate the TRIX. |

| ColorNormLength | Numeric | 14 | Number of bars over which to normalize the indicator for gradient coloring. |

| UpColor | Numeric | Yellow | Color to use for indicator values that are relatively high over ColorNormLength bars. Set to -1 to disable gradient color plotting. |

| DnColor | Numeric | Red | Color to use for indicator values that are relatively low over ColorNormLength bars. Set to -1 to disable gradient color plotting. |

| GridForegroundColor | Numeric | Black | Color to use for numbers in RadarScreen cells when gradient coloring is enabled, that is, when both UpColor and DnColor are set to non-negative values. |

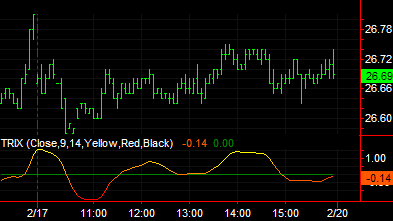

Market Synopsis

The Triple Exponential Average (TRIX) indicator is an oscillator used to identify oversold and overbought markets and it can also be used as a momentum indicator. As is common with many oscillators, TRIX oscillates around a zero line. When used as an oscillator, a positive value indicates an overbought market while a negative value indicates an oversold market. As a momentum indicator, a positive value suggests momentum is increasing while a negative value suggests momentum is decreasing. Many analysts believe the TRIX crossing above the zero line is a buy signal while closing below the zero line is a sell signal. Also, divergences between price and TRIX can indicate significant turning points in the market.

TRIX calculates a triple exponential moving average of the log of the Price input over the period of time specified by the Length input for the current bar. The current bar's value is subtracted by the previous bar's value. This prevents cycles shorter than the period defined by Length input from being considered by the indicator.

Two main advantages of TRIX compared to other trend-following indicators are its excellent filtration of market noise as well as its tendency to be a leading rather than a lagging indicator. It filters out market noise using the triple exponential average calculation thus eliminating minor short-term cycles that may otherwise indicate a change in market direction. Its ability to lead a market stems from its measurement of the difference between each bar's "smoothed" version of the price information. When interpreted as a leading indicator, TRIX is best used in conjunction with another market timing indicator to minimize the effect of false indications.

Plot Information

| Number | Name | Default Color | Description |

| Plot1 | TRIX | Yellow/Red | Plots TRIX value. |

| Plot2 | ZeroLine | Dark Green | Plots a horizontal line at zero. |

When applied to a chart, this indicator contains two plots, displayed in a separate subgraph from the price data.

Set either UpColor and/or DnColor to -1 to disable gradient plot coloring. When disabled, Plot1 color is determined by settings in indicator properties dialog box. Plot2 (ZeroLine) color always comes from indicator properties dialog box.