DMI (Indicator)

DMI (Indicator)

Input Information

| Name | Expression | Default | Description |

| Length | Numeric | 14 | Number of bars used to calculate the DMIPlus, DMIMinus, and ADX. |

| ADXTrend | Numeric | 25 | Value used as alert criteria. |

Market Synopsis

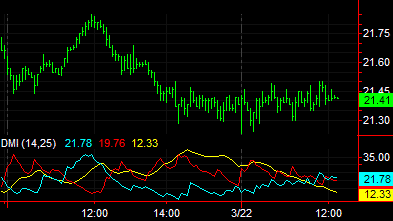

The DMI indicator calculates and plots the DMI Plus and DMI Minus values. DMI Plus is calculated from a comparison of the highs on a series of consecutive bars versus the true range; DMI Minus is calculated from the lows on a series of consecutive bars versus the true range. These values are used to calculate ADX, which is also plotted by this indicator. ADX is commonly used to indicate whether a market is trending.

Rising ADX values indicate a trending market without indication of the trend direction. The DMI Plus and DMI Minus, components of the ADX, can aid in identifying direction. DMI Plus crossing over DMI Minus is a bullish sign, and vice versa.

Plot Information

| Number | Name | Default Color | Description |

| Plot1 | DMI+ | Cyan | Plots the DMIPlus as a line. |

| Plot2 | DMI- | Red | Plots the DMIMinus as a line. |

| Plot3 | ADX | Yellow | Plots the ADX as a line. |

When applied to a chart, this indicator displays three plots in a separate subgraph from the price data.