OptionStation Pro

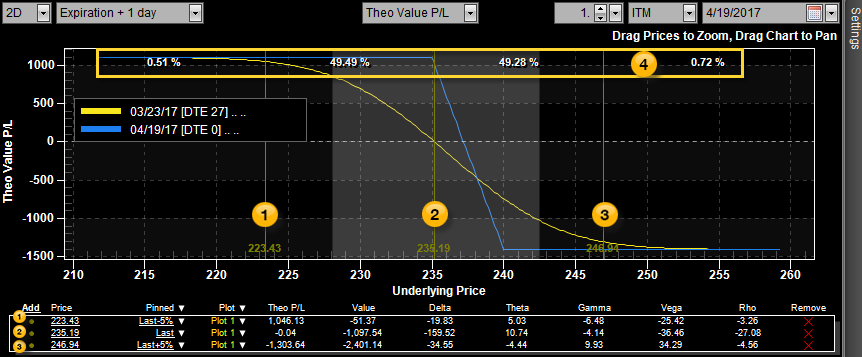

At the bottom of the 2D Graph you will find an area where different Price Points can be defined for real-time analyzing and monitoring. This is very helpful in determining what a profit or loss might be if the underlying asset price were to change 5% or 10% higher or lower for any plotted expiration. You can also see how the Greeks will behave with changes in the underlying asset. Price Point bar locations are automatically saved, and restored for you, on an underlying-by-underlying basis.

Add – Hover your cursor over Add and click the button to create a new individual Price Point row. By default, the row will use Last for the Price. You can create up to seven rows.

Color Dots – Color dots show the color of the Price Point bars in the Spread Profile. When you click on a dot, a color palette opens revealing many color choices.

Price – By default, this value is “pinned” to the Last price of the underlying asset. Clicking on this number will enable you to modify price by either using the scroll bar or typing over the current price shown. If the price is modified, it will be fixed to that value and not change with the market.

Pinned – Displays what price attribute the Price is “pinned” to, if any. If the Price is not pinned, this field will be blank. Clicking the arrow to the right of Pinned lets you automatically create multiple price points for combinations of percentage or standard deviation offsets above/below the Last. Clicking the arrow to the right of an individual price point row lets you change the specific pinned offset for that row.

Plot – Indicates the number of the Plot for which you want to display price point values. The color of the plot number will be the same as the referenced plot line. The number of plots is specified on the Risk Graph.

Remove – Deletes a price point row by clicking on the X to the right.

Theo P&L – Displays the current profit/loss of the selected Plot in dollars. The value displays in italics, with an asterisk (*) on the right, when one or more options that are graphed have negative extrinsic value. In this case, the Positions panel P/L values more closely track the actual market P/L values that you may experience when closing a position.

Value – Displays the current value of the selected Plot in dollars.

Greeks – Displays the Delta, Theta, Gamma, Vega, and Rho values of the selected Plot number.

The 2D Graph contains the following price point features:

Reposition the Price Point bars by directly dragging them to the left or right on the graph. Any movement made to the bars will change the corresponding values in their respective price point rows.

View the probabilities of the underlying asset moving to the Price Points. You can add up to seven Price Point bars and the corresponding probabilities will be displayed between each.

Each time you load a new underlying, OptionStation Pro will save the Price Point bar locations, so if you return to that underlying in the future, the bars will be automatically restored for you.