TradeStation Help

Range Bars were developed in 1995 by a Brazilian broker and trader, Vicente M. Nicolellis, Jr. The purpose of Range Bars was to focus only on changes in price; thus they do not close at a specific time, but instead only when the range is complete. Each bar has a specified price range, rather than being charted in units of time or ticks. With a focus on price movement, long periods of consolidation may be condensed into just a few bars, removing excess noise in the market and highlighting "real" price movements. So it is possible that an entire month of daily bars could fit into a single Range Bar, and the next month would have 30 Range Bars.

Range Bars are built by the underlying closing data that shows the directional trends as per the range amount. Range Bar charts are time independent so that time axis increments will not be fixed. The size of the bars will always be the range size set by you and will never be anything smaller or larger unless it is the current bar that is building.

Range Bars look like standard bars, but are different in several ways:

![]() This

is the primary difference between Range Bar and Momentum Bar charts.

This

is the primary difference between Range Bar and Momentum Bar charts.

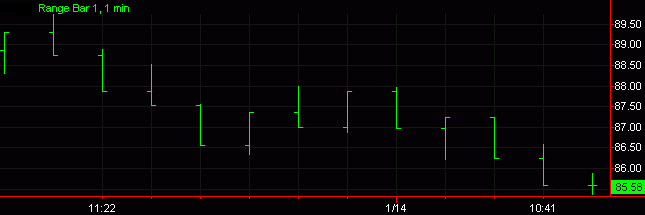

In this example, the Range Bar chart is using a Range of 1:

Since Range Bars are driven by price movement, a new Range Bar is only created once the specified Range has been met. For example, if the specified Range amount is $10, it means that each Range Bar will have a range (High to Low) of $10. It is thus conceivable that a single Range Bar could represent several days if the movement throughout those days was only within a $10 price range. Once a Range Bar is closed-out, the open of the next Range Bar will always be at exactly the same price as the Close of the prior Range Bar.

There are no gaps displayed on Range Bar charts, so when there is a price gap in the underlying data, "virtual bars" will be inserted as necessary to fill in the gap on the Range Bar chart. These "virtual bars" can be easily distinguished from "real" Range Bars by their Up Volume and Down Volume values, which will both be zero. In order for a bar to be considered a "virtual bar", there should be no real price activity contained within the bar.

The Range amount determines the size of the Range Bars on the chart. One should take careful consideration in the selection of the Range amount. As a rule, the specified Range amount should be greater than the normal oscillation of the underlying data. Selecting a Range amount that is too small will result in the creation of more bars in real-time than will be created when the chart is built historically.

Suppose that within a given five minute period prices oscillate between 10 and 12, going from 10 to 12, then back to 10 and then back to 12. If the Range amount for this chart were set to 1, in real-time this would result in six Range Bars, two from 10 to 12, two going back down to 10, and two more going back up to 12, as shown in the example below:

Since all of the aforementioned oscillations occurred within a five minute period (the specified underlying interval in this example) when the Range Bar chart is built historically, that five minute period would be represented by only two Range Bars, as shown in the example below:

Only two bars would be displayed, since information about the bar oscillations within that five minute period would be unavailable when building the chart historically.

It is important that the Range amount be greater than the minimum move of the underlying symbol, and it should also be evenly divisible by the minimum move or rounding errors may occur.

The Interval setting defines the interval of the data used to build the Range Bars. The appropriate interval depends on your market perspective. Users with a short-term perspective may benefit from using smaller intervals (more precision/noise). Users with a long-term perspective may benefit from larger intervals (less precision/noise).

Range Bars interpretation is similar to that of traditional bar charts.

Strategies can be effectively back-tested and automated on Range Bar charts when using an appropriate Range value and a '1 Tick' underlying interval. Automating strategies on this chart type using higher underlying intervals will yield real-time results that are inconsistent with back-test results. For additional information on back-testing and automating strategies on Advanced Chart Types, see Advanced Chart Types - Strategy Back-Testing & Automation.

![]() For a

comprehensive list of command line commands, see Command

Line References (All Commands) or Command

Line Reference (Sorted by Application).

For a

comprehensive list of command line commands, see Command

Line References (All Commands) or Command

Line Reference (Sorted by Application).