TradeStation Help

Point & Figure Chart

Point & Figure (P&F) charts have been used as far back as the late 1800's. This charting method focuses on price changes by eliminating time and volume; informing traders where price is relative to prior levels. Keeping this in mind, traders can decide whether today's price represents a continuation of a trend, a reversal or a breakout so that they may profitably trade the market tomorrow. In addition, Point & Figure charts filters out time and insignificant price changes, leaving you with a chart that contains only price movements that are relevant to you. These chart types differ from bar charts in two important ways:

- Price reversals below a user-defined minimum value are not shown - thereby filtering out price static.

- The time scale is variable; meaning the intervals on the horizontal axis vary. Therefore, a Point & Figure chart represents pure price movement.

Price changes are plotted as a series of vertical columns where up-trends are displayed as a column of Xs and down-trends are displayed as a column of Os. A column of Xs shows that demand is exceeding supply (a rally), and a column of Os shows that supply is exceeding demand (a decline).

How a Point & Figure Chart is Built

Point & Figure charts can be built based using the High/Low Range or the Close of the underlying data.

High/Low Range Basis

This construction method uses the High or the Low depending on the direction of the price. On rising days the high range is used for the calculation. On falling days, the low range is used. This method tends to highlight bullish or bearish sentiment. See  How is the High/Low Range Constructed? for more details. Please note that this is the method used to build Point & Figure charts in prior versions of TradeStation.

How is the High/Low Range Constructed? for more details. Please note that this is the method used to build Point & Figure charts in prior versions of TradeStation.

The rules below summarize the way in

which High/Low based Point & Figure charts are built:

When the

current column is a column of X's (an up column)

1. First, consider the High of the underlying

bar (the data used to build the Point & Figure chart).

2. If the High of the underlying bar

is higher than the High of the column of X's, by at least the Box

Size, you would add one or more X's, as appropriate, to the top of

the current column of X's. The rest of the underlying bar would

be ignored.

3. However, if the High of the underlying

bar is not high enough for an X to be added to the column, you need

to check for a reversal by checking the Low of the underlying data.

4. If the Low of the underlying bar is

less than the high of the column minus the reversal amount (Box Size

x Reversal), you would shift to the right and start a new column with

the required number of O's.

5. If the High of the underlying bar

is not high enough to generate a new X, and the Low of the underlying

bar is not low enough to merit a reversal, then the column of X's

will remain unchanged and the underlying bar will be disregarded.

When the

current column is a column of O's (a down column)

1. First, consider the Low of the underlying

bar (the data used to build the Point & Figure chart).

2. If the Low of the underlying bar is

lower than the Low of the column of O's, by at least the Box Size,

you would add one or more O's, as appropriate, to the bottom of the

current column of O's. The rest of the underlying bar would

be ignored.

3. However, if the Low of the underlying

bar is not low enough for an O to be added to the column, you need

to check for a reversal by checking the High of the underlying data.

4. If the High of the underlying bar

is greater than the Low of the column plus the reversal amount (Box

Size x Reversal), you would shift to the right and start a new column

with the required number of X's.

5. If the Low of the underlying bar is

not low enough to generate a new O, and the High of the underlying

bar is not high enough to merit a reversal, then the column of O's

will remain unchanged and the underlying bar will be disregarded.

This logic assures that the trend always

takes precedence.

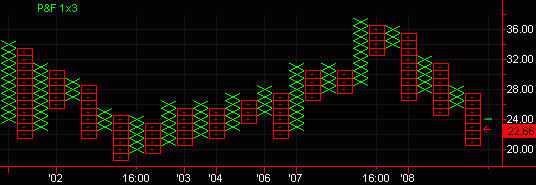

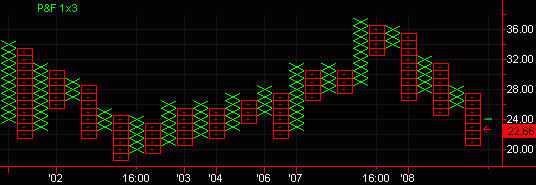

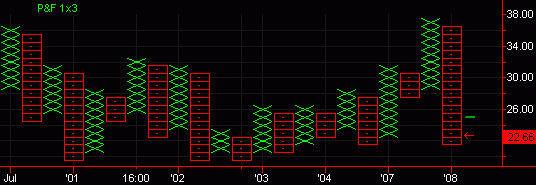

Point

& Figure chart using a monthly interval based on High/Low range:

Close Basis

This construction method uses takes the latest price as it is received and compares it to the last X or O plotted. If the Close confirms the current direction, the current direction continues. If the Close retraces the current direction by the Reversal amount or greater, a new column is created in the reverse direction. Thus, it uses the last price it receives either to continue with the current column or to create a new column if the price reverses by the prescribed amount. See  How is the Close Constructed? for more details.

How is the Close Constructed? for more details.

The rules below summarize the way in which Close based Point &

Figure charts are built:

When the current column is

a column of X's (an up column)

1. If the Close of the underlying bar is higher than the High of

the column of X's, by at least the Box Size, you would add one or

more X's, as appropriate, to the top of the current column of X's.

2. If the Close of the underlying bar is less than the high of the

column of X's, minus the reversal amount (Box Size x Reversal), you

would shift to the right and start a new column with the required

number of O's.

3. However, if the Close of the underlying bar is not high enough

to generate a new X, and not low enough to merit a reversal, then

the column of X's will remain unchanged and the underlying bar will

be disregarded.

When the current column is

a column of O's (a down column)

1. If the Close of the underlying bar is lower than the Low of the

column of O's, by at least the Box Size, you would add one or more

O's, as appropriate, to the bottom of the current column of O's.

2. If the Close of the underlying bar is greater than the Low of

the column of X's, plus the reversal amount (Box Size x Reversal),

you would shift to the right and start a new column with the required

number of X's.

3. However, if the Close of the underlying bar is not low enough

to generate a new O, and not high enough to merit a reversal, then

the column of O's will remain unchanged and the underlying bar will

be disregarded.

This logic puts a greater emphasis on the reversal.

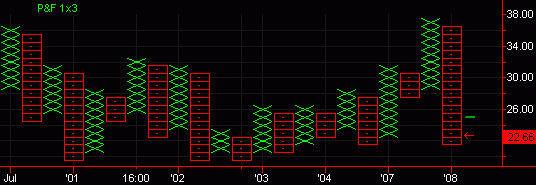

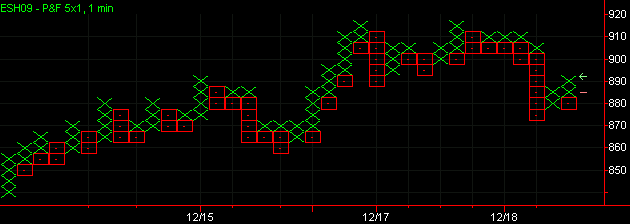

Point & Figure chart using a weekly interval based on a Close range:

Point & Figure Interval Settings

When creating a Point & Figure chart, you must specify the following settings:

- Box Size - The Box Size refers to the minimum increase or decrease in price needed to add an X or an O to a column of Xs or Os, respectively. For example, if you believe a half a point increase is significant, you can set this box size to 0.5. In a column of Xs, each time the price increases by .5, an X is added. In a column of Os, each time the price decreases by .5, an O is added.

The Box Size must be greater than the min. movement for the symbol, and should be evenly divisible by the min. movement or rounding errors

may occur.

- Reversal Amount - The Reversal Amount refers to the change in price, either up or down, needed to create a new column; in other words, reverse from a column of Os to a column of Xs (and vice versa). As an example, if you believe a reversal of one and a half points is significant, and you have set your box size to .5, then you should set your reversal amount to 3 (0.5 x 3 = 1.5). For instance, a column of Xs is being plotted, the price declines by 1 point, then goes back up a point. In this case, nothing is plotted. Now, the price increases again by half a point. Another X is added. Then, the price declines by 1.5 points. In this case, a new column is started as one O is plotted.

- Interval - The Interval setting specifies the interval of the data used to build the Point & Figure chart. The appropriate interval depends on your market perspective. Users with a short-term perspective may benefit from using smaller intervals (more precision/noise). Users with a long-term perspective may benefit from larger intervals (less precision/noise).

- Basis - The Basis setting determines the method used to construct the Point & Figure chart. The 'High/Low Range' selection uses the High and Low of the underlying data to build the Point & Figure chart. The 'Close' selection uses only the Close of the underlying bar to build the Point & Figure chart.

- One-Step-Back Column Building - The One-Step-Back selection is only applicable when the Reversal is set to 1. When enabled, this selection allows for an X and O to be plotted in the same column, in certain situations. This helps to consolidate price action when the Reversal is set to 1.

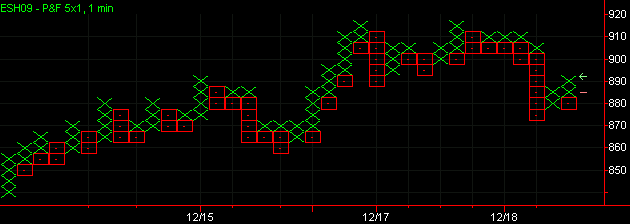

For example, during an up-trend

(column of X's), if the prices were to retrace, creating a single O in

the next column, and then resume its prior (opposite) direction, an X

and an O will be displayed in the same column, as shown in the example

below:

Point & Figure Chart Display

- The arrow displayed to the

right of the current column indicates where the current price is located

along the current column.

- The hash-mark displayed to

the right of the current column indicates where prices need to get

to in order for there to be a reversal.

- The dot displayed in the

center of the O's indicates price at which the O is plotted. The

price at which X's are plotted is indicated by the intersection of

the lines.

Additional Information

- When using a Point & Figure chart, multi-data

charts can not be created; only one symbol can be displayed on a Chart

Analysis window at a time.

- You can apply almost any analysis technique to a Point

& Figure chart, although you should not use analysis techniques

that base their calculation methods on time.

- For X columns, the 'Up Vol' will reflect of number

of X's in the column; for O columns, the 'Down Vol' will reflect the

number of O's in the column.

For a

comprehensive list of command line commands, see Command Line References (All Commands) or Command

Line Reference (Sorted by Application).

For a

comprehensive list of command line commands, see Command Line References (All Commands) or Command

Line Reference (Sorted by Application).

About the Chart Analysis Window

Point & Figure Chart Formations Library

Creating

a Point & Figure Chart

Formatting

a Point & Figure Chart

Using Trendlines with a Point & Figure Chart

View Price Values

How is the High/Low Range Constructed? for more details. Please note that this is the method used to build Point & Figure charts in prior versions of TradeStation.

How is the High/Low Range Constructed? for more details. Please note that this is the method used to build Point & Figure charts in prior versions of TradeStation. How is the High/Low Range Constructed? for more details. Please note that this is the method used to build Point & Figure charts in prior versions of TradeStation.

How is the High/Low Range Constructed? for more details. Please note that this is the method used to build Point & Figure charts in prior versions of TradeStation.

How is the Close Constructed? for more details.

How is the Close Constructed? for more details.

![]() For a

comprehensive list of command line commands, see Command Line References (All Commands) or Command

Line Reference (Sorted by Application).

For a

comprehensive list of command line commands, see Command Line References (All Commands) or Command

Line Reference (Sorted by Application).