TradeStation Walk-Forward Optimizer

The Walk-Forward Optimizer (WFO) now allows the user to perform a Monte Carlo Walk-Forward which is a combination of walk-forward analysis and Monte Carlo analysis. In essence the WFO is performing a Monte Carlo Analysis concurrent with the walk-forward analysis.

Where the existing Monte Carlo analysis feature (available on the Monte Carlo tab) is performed after a walk-forward analysis have already been completed, the new Monte Carlo Walk-Forward method allows one to apply Monte Carlo sampling while a walk-forward analysis is being calculated.

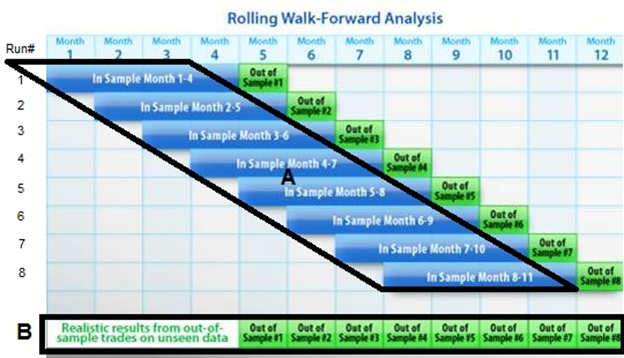

When the Monte Carlo box is checked on the Setup Optimization Settings dialog, a Monte Carlo analysis is performed on each of the in-sample runs (i.e. Run# 1-8 in section A in the figure below) .

Like the Monte Carlo tab, the concurrent Monte Carlo analysis calculates the analysis on the in- and out-of-sample trades (section B in the figure above) of the final Walk-Forward Equity graph, which is also displayed on the Graphs tab.

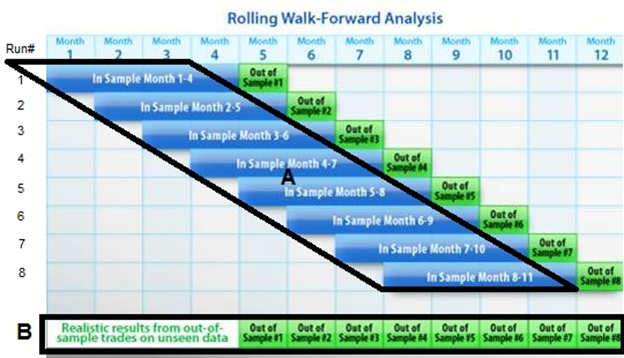

With a Monte Carlo Walk-Forward, the WFO will scan multiple times through the list of optimization tests (i.e. the total number of tests that were initially performed within TradeStation) and calculate the average of all the best solutions. WFO will then display the Average values in the Optimization Summary (In-Sample) and Walk-Forward Summary (Out-Of-Sample) report.

As such, the Monte Carlo Walk-Forward method cannot be used for periodic re-optimization purposes because the method does not list any input values to be used (i.e. the Inputs column of the Optimization and Walk-Forward Summary reports does not contain any values)

In essence the Monte Carlo Walk-Forward show the average results that can be expected if the same Walk-Forward Analysis is performed multiple times, yet with variations introduced by the Monte Carlo sampling procedure. (By default, the simulation method being used is Monte Carlo with Normal Distribution)

The Net Profits being displayed in the Walk-Forward Summary represent averages of multiple simulations. Thus it cannot be traced back to a specific trade list and accordingly the Graphs, P/L History and Performance Summary tabs are not available for a Monte Carlo Walk Forward.

Since several similar walk-forwards are performed, the computing time will be inevitably much longer than if the Monte Carlo option was not selected on the Setup Optimization settings dialog. If the Monte Carlo option was selected, then the Walk-Forward Analysis will take X times longer to compute, where X=the number of Simulations specified in the Monte Carlo Walk-forward box on the Setup Environment dialog.

While the default is 10 simulations, most users will probably settle for a value ranging between 5-20, as to result in a realistic computation time, depending on the speed of the computer available and number of tests per WFA. Because of the extended computation times involved, we need to warn users up-front that you need to carefully consider if the Monte Carlo Walk-Forward is suitable for your own use. In terms of efficiency, the WFO is fully multi-threaded and can utilize a multi-core CPU to its full potential, thus a long waiting time is a clear indication of how computationally intensive this method is.

It must also be noted that the Monte Carlo Walk-Forward is completely optional and only if you feel that you have the actual time and computing power available, then you may want to experiment with this new method. As such, we would not recommend using this method unless you are an experienced user of the WFO.

In conclusion: The purpose of the Monte Carlo Walk-Forward is to provide a different and more computing intensive (and potentially more conservative) view of the original walk-forward analysis. Ideally we want Optimization Summary and Walk-forward Summary reports that were produced by a Monte Carlo Walk-forward to convey a similar message as the same reports produced by a standard Walk-Forward Analysis. However, since the Monte Carlo Walk-Forward reports are based on averages, it is expected that the overall result may deteriorate from the original.