TradeStation Walk-Forward Optimizer

Monte Carlo Analysis

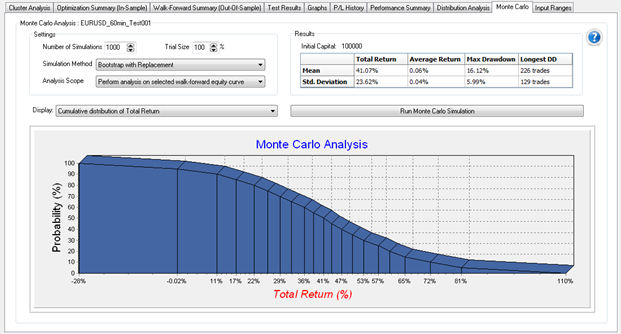

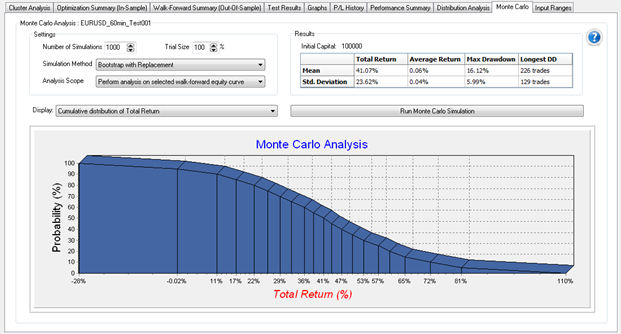

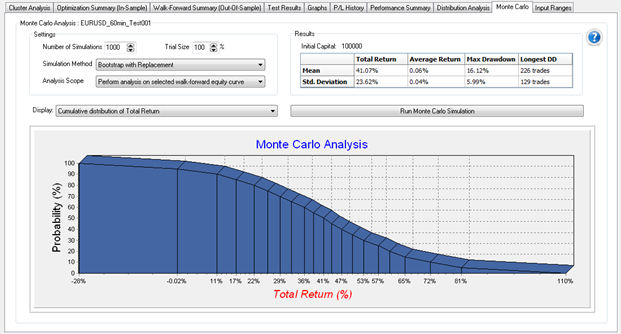

When viewing the results of a Walk-Forward Analysis, the Monte Carlo

tab lets you perform a Monte Carlo Analysis (MCA) to be able to

evaluate alternative statistical outcomes drawn from the historical data

distribution.

Monte Carlo Analysis in the Walk-Forward Optimizer allows you to re-sample

percent returns for a specified walk-forward equity curve or cluster analysis

containing multiple walk-forward equity curves. This type of simulation

lets you see what alternative possibilities and scenarios exist for different

parameters, including drawdown, and total return on equity within the

same statistical characteristics of returns.

The Monte Carlo Analysis graph allows you to view and evaluate the probability

of achieving a certain return or drawdown. For example, the graph above

indicates a 90% probability of achieving a total return of 11%.

The selections above the graph allow you to customize the information

displayed in the Monte Carlo Analysis:

Settings

- Number

of Simulations - Used to select the number of simulations,

i.e., the number of times the simulation is re-sampled (default =

1,000).

- Trial

Size - Used to select the trial size, which cycles the specified

sample value (default = 100%).

- Simulation

Method - Used to select the type of re-sampling that the

simulator will employ to generate the hypothetical data iterations.

The drop-down box allows choosing between:

- Bootstrap with replacement

– Utilizes real data from the walk-forward equity curve and replaces

the same values in the distribution after sampling, effectively

letting the same data be re-sampled for that specific iteration.

- Bootstrap without replacement

– Same as above, except it doesn’t return the value to the real

distribution for re-sampling. This method will not produce any

variation in total and average return but will display a cumulative

distribution graph for maximum drawdown and longest period between

equity peaks.

- Monte Carlo with normal distribution

– Uses a hypothetical distribution of values based on the standard

deviation and the mean of the real values from the actual walk-forward

equity curve distribution

- Monte Carlo with random trade

order – Uses the real data from the walk-forward equity

curve as is, and merely shuffles the order of the trades. Since

the actual trades are not replaced, this method will not produce

any variation in total and average return but will display a cumulative

distribution graph for maximum drawdown and longest period between

equity peaks.

- Analysis

Scope - Used to define the scope of the analysis. The drop-down

box allows choosing between using a selected walk-forward equity curve

(as determined by the current cell selected in the cluster analysis)

or using all cells in the cluster analysis.

- Display

- Used to select the graph to be displayed. The drop-down

box allows choosing between cumulative distributions of total return,

average return, maximum drawdown, and longest period between equity

peaks.

- Run

Monte Carlo Simulation - Button used to start the Monte Carlo

Analysis calculation.

Results

The Results matrix shows the simulation

results for mean and standard deviation for total return, average return,

maximum drawdown, and the longest period between equity peaks, i.e., longest

drawdown.

Run Monte Carlo Simulation - Clicking

this button performs the Monte Carlo Analysis using the specified settings

and displays values in the Results table as well as displaying a probability

graph.

You can also perform a Monte Carlo analysis concurrent with a WFO (see Monte Carlo Walk-Forward Analysis).

You can also perform a Monte Carlo analysis concurrent with a WFO (see Monte Carlo Walk-Forward Analysis).

![]() You can also perform a Monte Carlo analysis concurrent with a WFO (see Monte Carlo Walk-Forward Analysis).

You can also perform a Monte Carlo analysis concurrent with a WFO (see Monte Carlo Walk-Forward Analysis).