Monte Carlo Analysis

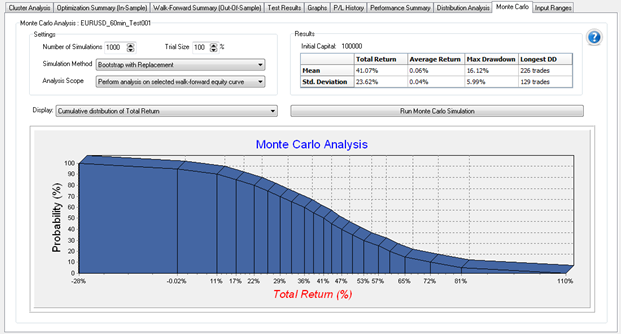

When viewing the results of a Walk-Forward Analysis, the Monte Carlo tab lets you perform a Monte Carlo Analysis (MCA) to be able to evaluate alternative statistical outcomes drawn from the historical data distribution.

Monte Carlo Analysis in the Walk-Forward Optimizer allows you to re-sample percent returns for a specified walk-forward equity curve or cluster analysis containing multiple walk-forward equity curves. This type of simulation lets you see what alternative possibilities and scenarios exist for different parameters, including drawdown, and total return on equity within the same statistical characteristics of returns.

-

Access from the TradeStation WFO by running a WFA and clicking the Monte Carlo tab.

The Monte Carlo Analysis graph allows you to view and evaluate the probability of achieving a certain return or drawdown. For example, the graph above indicates a 90% probability of achieving a total return of 11%.

The selections above the graph allow you to customize the information displayed in the Monte Carlo Analysis:

Settings

- Number of Simulations - Used to select the number of simulations, i.e., the number of times the simulation is re-sampled (default = 1,000).

- Trial Size - Used to select the trial size, which cycles the specified sample value (default = 100%).

- Simulation Method - Used to select the type of re-sampling that the simulator will employ to generate the hypothetical data iterations. The drop-down box allows choosing between:

- Bootstrap with replacement – Utilizes real data from the walk-forward equity curve and replaces the same values in the distribution after sampling, effectively letting the same data be re-sampled for that specific iteration.

- Bootstrap without replacement – Same as above, except it doesn’t return the value to the real distribution for re-sampling. This method will not produce any variation in total and average return but will display a cumulative distribution graph for maximum drawdown and longest period between equity peaks.

- Monte Carlo with normal distribution – Uses a hypothetical distribution of values based on the standard deviation and the mean of the real values from the actual walk-forward equity curve distribution

- Monte Carlo with random trade order – Uses the real data from the walk-forward equity curve as is, and merely shuffles the order of the trades. Since the actual trades are not replaced, this method will not produce any variation in total and average return but will display a cumulative distribution graph for maximum drawdown and longest period between equity peaks.

- Analysis Scope - Used to define the scope of the analysis. The drop-down box allows choosing between using a selected walk-forward equity curve (as determined by the current cell selected in the cluster analysis) or using all cells in the cluster analysis.

- Display - Used to select the graph to be displayed. The drop-down box allows choosing between cumulative distributions of total return, average return, maximum drawdown, and longest period between equity peaks.

- Run Monte Carlo Simulation - Button used to start the Monte Carlo Analysis calculation.

Results

The Results matrix shows the simulation results for mean and standard deviation for total return, average return, maximum drawdown, and the longest period between equity peaks, i.e., longest drawdown.

Run Monte Carlo Simulation - Clicking this button performs the Monte Carlo Analysis using the specified settings and displays values in the Results table as well as displaying a probability graph.

![]() You can also perform a Monte Carlo analysis concurrent with a WFO (see Monte Carlo Walk-Forward Analysis).

You can also perform a Monte Carlo analysis concurrent with a WFO (see Monte Carlo Walk-Forward Analysis).