About the Option Chain Page in RadarScreen

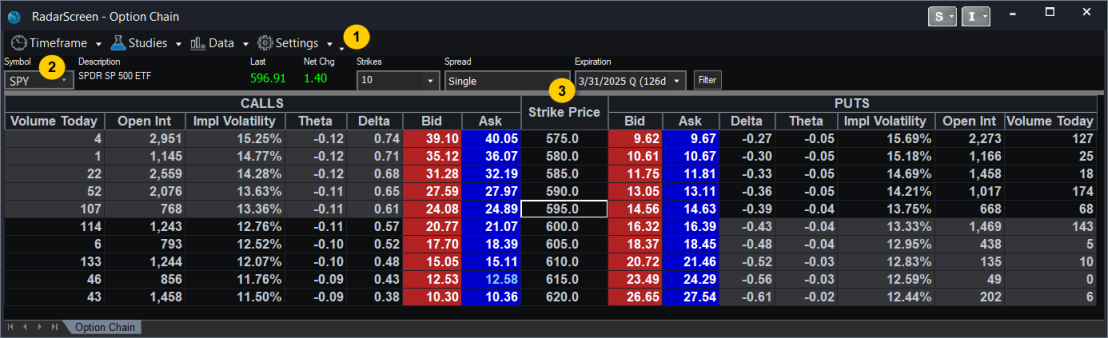

An Option Chain page in RadarScreen displays the put and call options for an underlying equity or index symbol.

One Option Chain page may be added to a RadarScreen window, up to a maximum of five RadarScreen windows (with one Option Chain page each).

The underlying symbol, expiration date of the options to be displayed, number of strike prices, and columns are all configurable (bubble 2 in the image below).

Call options are displayed on the left side of the page, put options on the right side. Every row represents a different option or option spread.

EasyLanguage studies cannot be applied to an Option Chain page in RadarScreen.

To add an Option Chain page to a RadarScreen window, see Adding Pages in RadarScreen.

Layout

Toolbar - Provides drop-down menus that control the features and settings of the window.

Toolbar - Provides drop-down menus that control the features and settings of the window.

Option Page Settings - Displays the underlying, a description of the underlying, the underlying's last price, and the underlying's net change for the day. Provides settings to control the number of strikes, the options spread (which may be set to Single to display individual options rather than a spread), and the expiration date of the displayed options.

Option Page Settings - Displays the underlying, a description of the underlying, the underlying's last price, and the underlying's net change for the day. Provides settings to control the number of strikes, the options spread (which may be set to Single to display individual options rather than a spread), and the expiration date of the displayed options.

Option Chain Panel - Displays information about the the individual options (or spreads).

Option Chain Panel - Displays information about the the individual options (or spreads).

How do you use it?

The Option Chain page lets you locate individual options or spreads on a specific underlying. Clicking the bid or ask cell on a row will populate the Trade Bar (or Spread Trade Bar) automatically with the symbol(s) from the row that is clicked.

- Enter a symbol for which you wish to view available options in the Symbol combobox near the upper left-hand corner of the window.

- To the right, on the same row as the Symbol combobox, choose the number of strike prices that you wish to view.

- Select the appropriate spread, or "Single" to view individual options.

- Select the desired expiration date. Click the Filter button to adjust the number of expirations and/or types of expiration shown.

- Optional:

Choose which columns to display. From the Settings menu, click Columns to modify an individual column or the list of displayed columns. The columns in the Option Chain panel can be added, removed, sorted, repositioned, and copied to your clipboard.

Default columns (in order of appearance)

Volume Today - The option volume traded today, since the beginning of the session.

Open Int – The total number of open option positions for the specific option contract.

Impl Volatility - The volatility that is implied by the price of the option.

Theta - The Theta (time) sensitivity of the option.

Delta – The Delta (underlying price) sensitivity of the option.

Bid – The current bid price of the call or put option.

Ask – The current offer or sale price of the call or put option.

Strike – The strike price(s) of the option(s) represented by the row.

Other available columns (in alphabetical order)

Ask Size – The number of contracts being offered for sale for each strike shown.

Bid Size – The number of shares being offered for purchase for each strike shown.

Bid-Ask - The difference between the current bid and ask prices.

Close – The current option price.

Extrinsic – The time value portion of the options price.

Gamma – The Gamma sensitivity (sensitivity to changes in Delta) of the option.

High – The high price of the asset for the day.

Intrinsic – For calls: the intrinsic is max[underlying price - call strike price, 0]. For puts: max[put strike price - underlying price, 0].

IV Skew Vol – The IV Skew Approximation volatility values.

Last – The last traded price of the option.

Low – The low price of the option for the day.

Mid – The mid price is the average of the bid and ask prices.

Net %Chg – The net change in percent since the last daily close.

Net Chg – The net change of the asset since the last daily close.

Open – The opening option price from regular trading hours.

Position – The number of contracts (+ for long and - for short).

Prev Close – The closing price from the previous regular trading session.

Prob BE – The probability of breaking even at expiration.

Prob ITM – The probability of expiring in-the-money for each single option.

Prob OTM – The probability of expiring out-of-the-money for each single option.

Rho – The Rho option sensitivity of the option.

Symbol – The symbol for each option.

Theo Value – The theoretical value displays the theoretical option price.

Vega – The Vega (volatility) sensitivity of the option.

Option prices and calculated values (e.g., Greeks) update at the periodicity specified under Settings-Preferences-Option Chain. See RadarScreen Preferences - Option Chain.