Determining the Intrinsic Value and Time Value of an Option

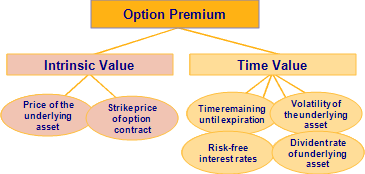

There are six major factors that determine the intrinsic value and time value of an option, which in turn affects the premium of that options contract. These factors are:

- Price of the underlying asset

- Strike price of the options contract itself and type of option (put or call)

- Time remaining until expiration of the options contract

- Volatility of the underlying asset

- Current risk-free interest rate (usually based on Treasury bills)

- Dividend rate of the underlying asset, if any

The first four factors have the most influence on the value of the options contract. The underlying asset price and its relationship to the strike price of the options contract are the most important factors. The time remaining until expiration is another. The more time remaining until expiration, the more time value the options contract has. If the underlying asset price falls far below or far above the strike price of the option, the underlying asset becomes more dominant in determining the price of the option. On the day the option expires, the only value the options contract has is its intrinsic value, that is, the amount by which the options contract is in-the-money.

More volatile underlying assets have relatively higher option prices because their prices are more likely to swing toward an increase or decrease in price than a less volatile underlying asset, thus lending the options contract more likely to become profitable.

The risk-free interest rate is generally based on the rate of 90-day Treasury bills. Higher interest rates can increase option premiums somewhat; lower rates imply lower premiums. Dividends for the underlying asset can also affect the premium of an options contract. Dividends can lower the call option premium because they lower the price of the underlying asset, and conversely, dividends can increase the price of a put option.

The graphic above illustrates intrinsic and time value, and the factors that impact both of these values. There are other factors that can affect the premium of an options contract. The general trend of the market can have an affect on option prices. If the market is particularly bullish or bearish, call or put option premiums often increase because of increased demand. Also, trader sentiment toward a particular underlying asset or market trend in a particular industry can affect option premiums.

The pricing of options contracts is not standardized, and is determined on the floor of the exchange where that option is traded between the buyers and sellers. Option prices are quoted similar to the method used by their underlying asset. The option will have a bid and an ask; however, many times the price you pay to purchase or to sell the option lies somewhere in between.

When trading options, it is advisable to always check with your broker or brokerage firm to determine the correct bid/ask price of any options contract you wish to trade. It is also important to note that some data vendors supply options pricing data on a delayed basis, and sometimes the pricing data can be incorrect or incomplete.