Analysis Techniques & Strategies

| Name | Expression | Default | Description |

| Price | Numeric | Close | Price to consider for the pivot point. |

| LeftStrength | Numeric | 3 | Number of bars before the pivot point that must be lower than the pivot price. |

| RightStrength | Numeric | 3 | Number of bars after the pivot point that must be lower than the pivot price. |

| PlotOffsetTicks | Numeric | 1 | Number of price ticks to offset the plot from the pivot high. |

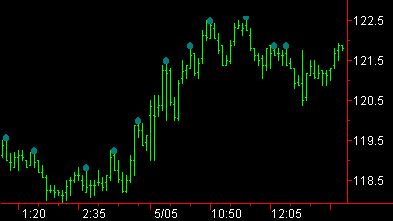

The Pivot High ShowMe study identifies high pivot points; by default, it places a dot at the high price of the bar plus 1 price tick (minimum price increment amount) when the high price is greater than the high price of the three previous bars, and greater also than the high price of the subsequent three bars. You can change the price used to calculate the pivot, the strength of the pivot, and the number of price ticks to offset the plot from the pivot high price.

Pivot points are used to calculate support and resistance levels, with a high pivot indicating the resistance level, and the low pivot indicating a support level. When price penetrates the resistance line as calculated by the high pivot, it is considered a breakout and the resistance level generally becomes the new support level.

![]() This ShowMe study contains alert criteria; when you enable the alert, an alert is triggered each time a pivot point is found. Due to how pivot points are calculated, you will be notified x number of bars after the pivot point has occurred (where x is the number you use for the RightStrength input).

This ShowMe study contains alert criteria; when you enable the alert, an alert is triggered each time a pivot point is found. Due to how pivot points are calculated, you will be notified x number of bars after the pivot point has occurred (where x is the number you use for the RightStrength input).