TradeStation Help

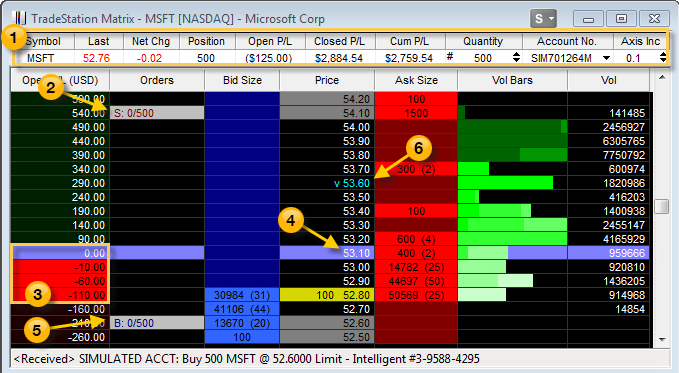

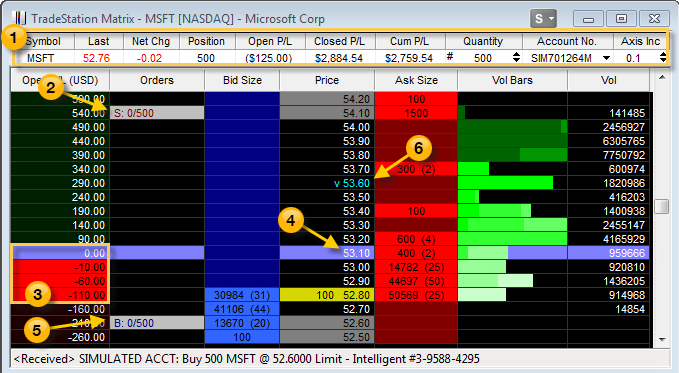

In addition to providing at-a-glance market depth information, the Matrix window allows TradeStation clients to display the average position price with associated P/L for open positions for the current symbol along with the symbol's VWAP (Volume Weighted Average Price) for the session. The Quote Bar is used to view general order settings while the P/L, Orders, and Price columns display position information and open order status. For information about price and volume values, see Matrix Price and Volume.

| Field Name | Description |

|---|---|

Quote Bar |

The Quote Bar displays a summary of position and order values for the current symbol. By default, the first several columns display the symbol name, net change in position, open position shares/contracts, and open position P/L (profit/loss for the open position). |

Open Orders |

All Open Orders will be displayed in the Orders column. Buy orders will be preceded by a B and sell order by an S. A second S will indicate that the order is a Stop order. Each open order cell displays two numbers: the first represents the number of shares/contracts actually filled and the second the number of shares/contracts remaining to complete the order. |

Open P/L |

If you have an open position, then the P/L column will display a scale consisting of the position's break-even point with position (profit) values above and negative (loss) values below.

|

Position (Avg Cost) |

The average price of an open position for the current symbol is identified by changing the color of the price cell at the average price level. As you add or remove from the position, the location of the Position (Avg Cost) cell will change. If the average price of the position is the same as the Last price, then the Last price cell coloring will take precedence. However, you'll still be able to determine the location of the average price by matching it to the zero point in the P/L column. |

Potential Order Type |

The order type and price of a potential order are highlighted whenever the cursor moves over a bid or ask price. Buy orders are initiated from the Bid column and sell orders from the Ask column. The type of order matches the LMT / STP / STL selection from the Trade Order bar. |

VWAP |

The VWAP (Volume Weighted Average Price) consists of a marker to the left of the price at which the majority of a given day's trading in a given security took place. VWAP is calculated by adding the currency amount traded for the average price of the bar throughout the day ("avgprice" x "number of shares traded" per bar) and dividing the total shares traded for the day. See Matrix Attributes for more information about VWAP reset methods. |