TradeStation Help

About ActivityBar Studies

ActivityBar studies are a powerful, innovative type of analysis techniques.

ActivityBar studies provide you with look inside-a-bar technology, which

enables you to display and analyze transactions that occurred within each

bar on your chart. You have access to plot trade record, bid record, ask

record, volume, splits and implied volatility overlaid on standard time-based

price bars at any data interval. You define the time frame of the bar

chart you create, and then, using an ActivityBar study, break that time

frame into smaller increments, or "cells."

There are five built-in ActivityBar studies, each provides you with

a different type of analysis. You can also create your own analysis technique

using EasyLanguage in the TradeStation Development Environment. Just like other

analysis techniques, ActivityBar studies are written using inputs, which

means you can format the studies as you apply them to a chart and customize

them to your liking.

You can also base indicators and trading strategies on an ActivityBar

study, which provides you with an entire additional layer of data and

analysis. For example, you can base a trading strategy on whether or not

a certain amount of data fell within a specific "zone" on the

price bar. For one simple example, you can see whether or not 50% or more

of the prices were in the top third of the bar.

You can use ActivityBar studies to formulate trading strategies, in

part or whole, on relationships that occur within a price bar and not

just between the volume, open, high, low, and/or closing prices of the

bars. This opens up a new and richer way of viewing your markets.

How ActivityBars Work

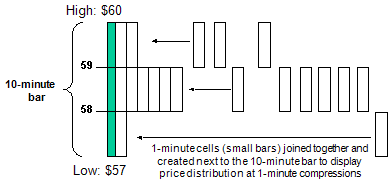

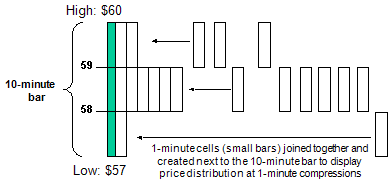

To illustrate how ActivityBar studies work, we'll use the Price Distribution

ActivityBar study. This ActivityBar study enables you to create a 10-minute

bar chart, for example, but also allows you to see the prices at which

most of the trading occurred, overlaid directly on the 10-minute chart.

When you insert and format the ActivityBar study, you define the size

of your ActivityBar cells by specifying the data interval to use. In this

example using a 10-minute price chart, you can choose 1-minute, 2-minute,

or 5-minute data interval. The 1-minute interval will give you ten cells

(10 minutes divided by 1 minute equals 10 cells); the 2-minute interval

will give you five cells (10 minutes divided by 2 minutes equals 5 cells);

and the 5-minute interval will give you two cells (10 minutes divided

by 5 minutes equals 2 cells). The idea is to choose a data interval for

your ActivityBar study that is divisible into the interval of the underlying

price chart (in this case, 10 minutes).

Let's say you insert the Price Distribution ActivityBar study in your

10-minute chart and set its data interval to 1-minute. Each 1-minute time

unit will be displayed as a cell on one side of the 10-minute bar to reflect

where the closing price fell during that period of time (by default, the

cells will display to the right of the bar). Each additional cell is created

consecutively, reflecting the position of the closing price during the

next time unit, until enough cells are created to total the time frame

of the bar. In this example, there will be a total of ten 1-minute cells

for the 10-minute period.

The figure below illustrates how a typical ActivityBar is built. As

you can see, the ActivityBar study enables you to pinpoint the most heavily

traded price point within that bar (in this example, 58 to 59).

In the above example, we specified an ApproxNumRows of 3. ApproxNumRows

is the input for all ActivityBar studies that allows you to specify approximately

how many rows you want the study to build. In this case, since we specified

three rows and the trading range is 57 to 60, all closing prices between

57 and 58 will be grouped together. You can specify more rows if you want

to break down the data even further. You can change virtually all aspects

of an ActivityBar study; for example, whether or not to display the cells,

the individual colors of the cells, and more, depending on the individual

study.

Each of the built-in ActivityBar studies provides a different type of

analysis, and you can format these studies to display the way you want;

however, the concept of how the ActivityBars are created is the same.

Due to their construction, ActivityBar studies may not be applied to

tick or Point & Figure charts. Also, like a trading strategy, you

can only apply one ActivityBar study to a chart at a time, and the ActivityBar

study is always applied to Data1. You cannot specify the subgraph in which

you want to display the ActivityBar study; the ActivityBar study is always

applied in the subgraph along with Data1.

Also, to accommodate the cells, the open and closing prices are identified

with larger arrows, which you can choose to display using the formatting

options.

See

ActivityBar

Study Library for detailed descriptions and illustrations of each

ActivityBar study.

See

ActivityBar

Study Library for detailed descriptions and illustrations of each

ActivityBar study.

Inserting

Analysis Techniques in a Chart or Grid Window

Formatting ActivityBar Studies

Setting an Alert

for an ActivityBar Study

Enabling an Alert

for an ActivityBar Study

Disabling an ActivityBar

Study

Removing an ActivityBar Study