Analysis Techniques & Strategies

| Name | Expression | Default | Description |

| PriceH | Numeric | High | Price used as the upper end of range to calculate SlowK. |

| PriceL | Numeric | Low | Price used as the lower end of range to calculate SlowK. |

| PriceC | Numeric | Close | Value used as current price to calculate SlowK. |

| StochLength | Numeric | 14 | Number of bars used to calculate SlowK. |

| SmoothingLength1 | Numeric | 3 | Number of bars used to slow FastK to FastD. |

| SmoothingLength2 | Numeric | 3 | Number of bars used to slow FastD to SlowD. |

| SmoothingType | Numeric | 1 | 1 = original, 2 = legacy |

| OverSold | Numeric | 20 | SlowK level considered oversold. |

| OverBought | Numeric | 80 | SlowK level considered overbought. |

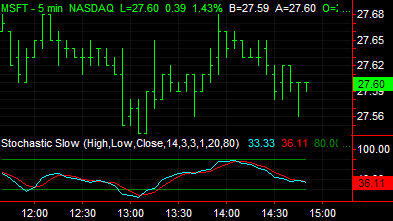

The Stochastic Slow indicator calculates the location of a current price in relation to its range over a period of bars. The default settings are to use the most recent 14 bars (input StochLength), the high and low of that period to establish a range (input PriceH and PriceL) and the close as the current price (input PriceC).

This calculation is then indexed, smoothed and plotted as SlowK. A smoothed average of SlowK, known as SlowD, is also plotted. SlowK and SlowD plot as oscillators with values from 0 to 100. The direction of the Stochastics should confirm price movement. For example, rising Stochastics confirm rising prices.

Stochastics can also help identify turning points when there are non-confirmations or divergences. For example, a new high in price without a new high in Stochastics may indicate a false breakout. Stochastics are also used to identify overbought and oversold conditions when the Stochastics reach extreme highs or lows. Additionally, SlowK crossing above the smoother SlowD can be a buy signal and vice versa.

| Number | Name | Default Color | Description |

| Plot1 | SlowK | Cyan | Plots the SlowK as a line. |

| Plot2 | SlowD | Red | Plots the SlowD as a line. |

| Plot3 | OverBot | Dark Green | Plots the overbought level reference line. |

| Plot4 | OverSld | Dark Green | Plots the oversold level reference line. |

When applied to a chart, this indicator displays four plots in a separate subgraph from the price data.