Analysis Techniques & Strategies

| Name | Expression | Default | Description |

| AdvIssues | Numeric | Close of Data1 | Price data considered as Advancing Issues. |

| DecIssues | Numeric | Close of Data2 | Price data considered as Declining Issues. |

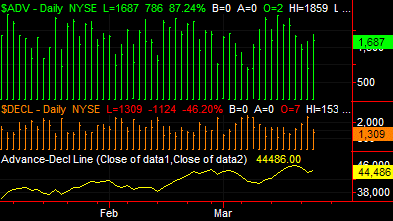

The Advance-Decl Line indicator calculates the difference between advancing issues and declining issues and plots the cumulative total of this value for the chart. The difference between advancing issues and declining issues is known as market breadth. For example, if a stock market index is rallying but there are more issues declining than advancing, then the rally is narrow and much of the stock market is not participating. To plot the Advance-Decline Line accurately, the chart must contain both the Advancing Issues and the Declining Issues and the inputs must specify the correct data number for each. Because the Advance-Decline Line begins accumulating values from the left of the chart, the numeric value of the Advance-Decline Line will depend on the data available in the chart. Therefore, the relative value, or trend direction, of the Advance-Decline Line is more important than its numeric value.

| Plot Number | Plot Name | Default Color | Description |

| Plot1 | A/DLine | Yellow | Plots the Advance Decline value. |

When applied to a chart, this indicator displays one plot in a separate subgraph from the price data.

![]() In order to apply the Advance-Decl Line indicator to a chart, you must plot two symbols. Data1 represents the number of advancing issues and their volume. Data2 represents the number of declining issues and their volume. Historically, Advance-Decl Line is applied to the NYSE Advancing issues (Data1) and NYSE Declining Issues (Data2).

In order to apply the Advance-Decl Line indicator to a chart, you must plot two symbols. Data1 represents the number of advancing issues and their volume. Data2 represents the number of declining issues and their volume. Historically, Advance-Decl Line is applied to the NYSE Advancing issues (Data1) and NYSE Declining Issues (Data2).